Back in early February, I noted that sales during the past holiday were slow and that the back issue market appeared to be trending down. I wondered if comics had peaked, which did not sit well with the faithful. My write up turned out to be somewhat polarizing but it also brought fourth some interesting ideas and view points in the comments section. Soon after, while trolling through he financial news, I stumbled across a comment made by Warren Buffet, stating in his annual letter that there was negative sentiment in the US due to the presidential hopefuls who couldn’t stop talking about all the problems in the US. This sounded more rational to me as a causation for the decline that began last November. This negativity has been reflected in many other markets as well, resulting in a general softness in the economy.

It’s important to note that the recovery from the US housing crisis has been slow and tentative. Although we’ve come a long way, the economy is nowhere near as strong as it was during the years leading up to 2008. US car manufacturers have been brought back from the brink of bankruptcy and news of financial giants such as the Lehman Brothers filing Chapter 11 no longer permeate the media but the economy remains fragile. Many financial pundits feel that we are headed into another storm, possibly bigger than the one we were in during 2008. However, there will always be people warning of doom and gloom, even during the best of times. Such is the state of the media in the digital age where everyone has an opinion. But still, the debt is real and if you believe in cycles, we are due for some bad weather.

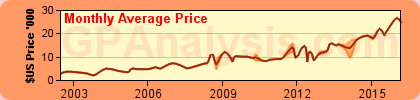

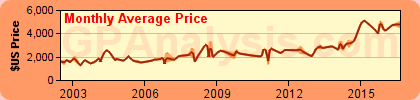

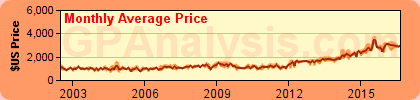

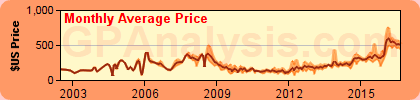

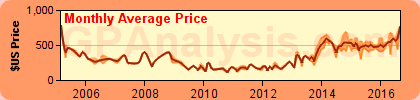

Where the comic market is concerned, it appeared as if the investment books were back on track leading up to Spring. Using the bellwether Hulk #181 as a gauge, it broke new ground back in April. However, this uptick was short lived and the market trajectory resumed its previous trend. Although the growth has stalled this year, the good news is that the books do not appear to be dropping either and remains flat. The market has been on a tear since 2012 so one could view this slowdown as a good sign. Corrections help to deflate bubbles and soften the blow should an economic downturn occur.

Comic book movies have been credited with the current speculative craze, a theory which has never sat right with me since comic book movies have always been around. For me, the question remains, why now? A moot point for many because most people simply don’t care and if enough people believe something, it has a way of becoming true. Self fulfilling or not, and depending on when you feel the comic movie boom began, superhero films are maturing. I still believe that it was Sam Raimi’s first Spider-Man that shook both the comic and movie communities, bringing in over $821m in 2002. Interestingly, both Dawn of Justice ($897m) and Suicide Squad ($720m) are well within the $800m range but are seen by many as failures… as opposed to movies such as Civil War, the Force Awakens and even Zootopia, all Disney productions, all hitting the billion dollar mark. Disney leads the billion dollar club, Universal is a distant second with films like Jurassic World leaving Fox, Sony… and yes Warner Bros scrambling to maintain their footing in the club. Much of this is based on expectations of course. Deadpool brought in $782m, while Guardians of the Galaxy amassed $773m but these were considered huge successes. As long as there is enough money left over after paying off the investors, production costs and the tax man, I suspect the studios will continue to produce “spectacle” driven movies despite all the criticisms. If the average movie goer watches an average of one movie per month, the trend shows that they are more likely to buy a ticket for these “tent pole” attractions, making it more difficult for indy artisan films to be made, which is kind of a shame. It’s been almost 15 years of superhero movies and between Disney, WB, Fox and Sony, we are about to be introduced to 6 to 10 superhero films each year. This is on top of other “spectacles” such as Star Wars, Avatar and all the video game/toy franchises. Will the general public be able to distinguish all these movies? Can they absorb so many similar films? There are some signs of fatigue, mostly from critics, but in the end, it’s hard to argue with box office numbers.

Let’s switch gears to politics. In just over a month from now, the US will have a new president. I personally can’t remember a time when we (and by we I mean collectors on both sides of the border) have had two candidates who are equally disliked. Interestingly, if the recent leaked emails from Colin Powell reveal anything, it is that people in high office are just like us. Despite having more access to information and resources, they seem to see what we see. Clinton has trust issues but she has the experience and the political cred. Trump lacks temperament but he could be the change that people are wanting, someone from the outside to disrupt the tired political system. But even if Warren Buffett’s observation holds true, don’t expect the comic market to come roaring back after the election. It will take time for the US to transition, which could be viewed as an opportunity for collectors to load up or cash out depending on your mindset.

It’s been an amazing summer for me. The weather was awesome and I got to spend most of my time with my kids camping up north. If there is one thing I enjoy more than comics, it has to be the natural world. Now that the year is winding down, typically, collectors can look forward to increased activity as we approach the holiday season. However, the flip side to my summer has been that online sales has been slow. Virtually at a stand still. The few buyers that are still active are not willing to pay a premium for books which is causing GPA to flat line, and I suspect this trend will carry forward into the holidays. Of course, eBay is not the be-all or the end-all for comics. I’ve had a slight increase in direct sales, the lack of fees being favourable for both buyer and seller, and certain books continue to do well. Also, there are more comic shows than ever before so trade does continue. However, a slow down on eBay may be an indication of things to come. Comics have had an amazing run, I don’t think any of us can complain about that, but being able to see what’s coming down the pipe is an advantage that can help with your decision making today.

As I’ve said in the past, I make no predictions about what the future holds, but I do think it’s important to keep an eye on the influences that can affect the economy, and ultimately our hobby. With the robust superhero genre in Hollywood now maturing, with the US in transition and another holiday season fast approaching… I’ll be holding my breath to see how things play out in the near term.

I will be attending New York Comic Con next week. I have been thinking about the future values of these same comics. I’ve sort of planned my show floor map to hit all the comic vendors and compare the asking prices of several titles. It should be fun. Nice article, by the way!

Please come back and share your findings!

I shall!

Hey Alan

In NYC please come by the ICE booth and say hi, International Comic Exchange

Another interesting post Charlie. It took me a while to get past that picture of Wonder Woman -she is stunning.

I too have had a problem with believing that movie speculation is the sole reason for comic appreciation. Some clearly are – Fantastic Four #52, Batman Adventures #12, New Mutants #98 these books languished for years before going nuts with movie announcements. Amazing Spider-Man #3 & #14,, Fantastic Four#1 & #48 are examples of books that were already recognized as key books prior to the movies that went up but not insanely so.

I know some comic dealers who insist their stores and shows do better in a recessionary times. Don’t know about that. They may get a chance to test their theory sooner than later though as recessions seem to run in cycles, occurring about every 7-10 years. Let’s hope it’s at least 10!.

I think movies definitely do influence the comic market NOW, because so many people believe it. However, I’m not sure why Mr. Freeze, the Riddler or X-Men #4 didn’t spike in value when these respective characters made their movie appearance prior to 2012. It leads me to think that there must have been some other catalyst to cause the current reaction. We may never know…

The only business that does well during a downturn are the BANKS! I’m not saying that the system is rigged… even though it is. Here’s hoping that any bad climate will be a mild one.

Everyone catch the debate? If Trump is unable to release his taxes due to the audit, then why did he turn around and say he’ll release them if Hilary releases the emails? So can he or can’t he…? So full of contradictions…

Another interesting post Charlie. I like how you connect the comic book market with world economy and politics.

Yes, no doubt the tv and movie studios’ interest in comic book properties are a big driver of some books value. I feel that the high end Silver Age books (e.g. high grade copies of AF #15, X-Men #1, etc) are surging in value because of 1. Scarcity and and also are affected to a smaller extent by 2. Ultra low interest rates that the world’s central bankers imposed in an effort to “reflate” the world economy after the 2008 crash. After the crash, there are fewer investment vehicles that will give a decent return, and that’s why I feel more people are now plowing their cash into high end Silver Age keys because they have tremendous cultural currency.

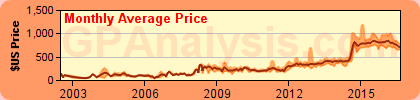

Another issue: I notice that the key issues of villains drop off the most in value after the movie has run its course (for example, see X-Factor #6, Avengers #55 as primary examples). I base the evidence from the price trends provided by gocollect.com, which shows that CGC copies in all grades of these 2 books have dropped a lot. Currently, Superman’s Pal Jimmy Olsen #134 (1st Darkseid) has rocketed in value, but I think its value will also see a big correction after the Justice League 1 and 2 movies pass thru the theatres. I call it the one and done phenomenon as a movie villain usually has that one movie appearance and is forgotten. The heroes tend to return in another movie, and seem to hold their values better because they can sustain the interest from the general public.

Thanks Peter. I like to step back and look at the big picture once in awhile.

I think interest rates are one thing but also… because of the low birth rate in Canada, the government has opened the immigration doors wider to let more people in. As a result, population is growing and contributing to the real estate boom because people need a place to live. I think the Government is very aware of the aging population and historically, it’s the generation behind that fund the pensions of our seniors. Considering how big the baby boomers are, I think the Government has anticipated a shortage in funds, so part of their solution has been to bring in more tax payers.

I resisted talking about Greece (out of sight, out of mind) and Brexit. I find it laughable that the 3 main proponents, David Cameron, Nigel Farage and Boris Johnson all quit. After the trouble they caused… they basically said, “it’s not my problem, I’m getting out of here”!

I’ve tried to provide some context, the backdrop in which the comic market operates. Perhaps change will be a good thing since there are opportunities even during bad times. Speculators can buy and sell according to their own beliefs.

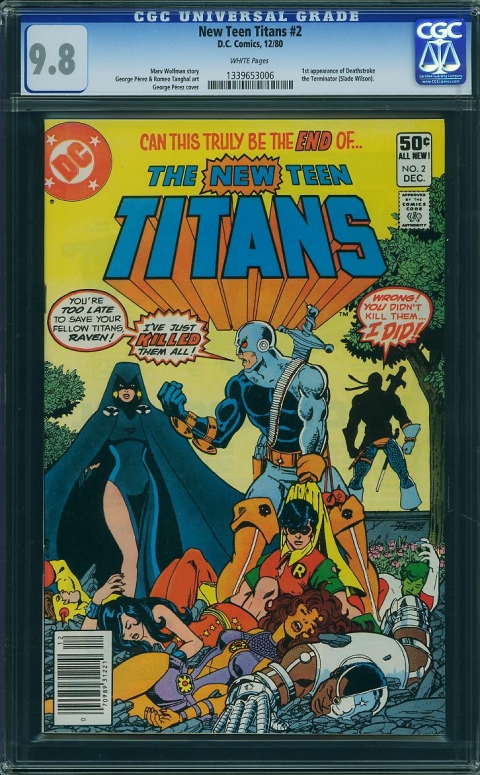

Yes… Ultron, Apocalypse… as well as Zemo, Doomsday, Crossbones, Ronan… the pattern is always the same, so why should Thano’s fair any better. Loki and Kingpin you say? Well, JIM#85 and ASM#50 are older books and they are both recurring characters, which is why I highlighted Deathstroke should the rumours pan out… although, NTT#2 is a very new book.

It’s not just the villains of course. Check in on high grade copies of Star Wars #1, FF#45, Fear#19 or Hulk#271. Rocket Raccoon and Star Wars may pick up again with their respective upcoming movies but at what point does the novelty wear off? Will speculators “get it” or will religion always mean blind faith as buyers continue to ignore the stats. There are winners of course. The SA keys continue to do well but their rise is much more steady. However, I would still avoid the early ASM villains as an investment.

As a general rule, I would say most books are worth what they are worth before the spike. Playing the spec game may be fun but just remember that the money has to come from somewhere.

Thanks for chiming in.

Thanks Charlie, for pointing out the price drops for SW#1, FF #45, Fear 19 and Hulk #271. So price corrections happen for key issues of heroes that are supposed to come back in future movies. I’m surprised to hear that the price of FF#45 has corrected lately – I guess the hype over the Inhumans (and FF45 prices) has gotten ahead of itself.

It’ll be interesting to see how the Batman/Deathstroke movie performs. And yes, NTT #2 will likely have a big price correction after the Batman movie has rolled through the movie-plexes.

Although it’s not official, it’s widely believed that the InHumans movie is cancelled, which has caused FF#45 to sink. So depending on what you believe, it may be a good time to pick up a copy now that it’s cheap and hope that the movie is not cancelled, or get out of the book all together before it sinks further.

Recent so called leaks on 4Chan and Reddit suggest that the Cyborg movie will be replaced with a Teen Titans movie with Deathstroke as the main villain, as well having appearances in other movies like Batman, JL… etc. But this is highly speculative so I would take this with a grain of salt. But it may be a good time to pick up 1st appearances of Nightwing, Beastboy, BB#54… etc. The trick is to get in early… although Tales of TT#44 is another dollar book that has really appreciated over the years.

Will do!

Charlie, I’ve enjoyed both of your posts this year regarding the state of the market, and the plethora of comments on the topic. You struck a chord! I was surprised by some scathingly critical reactions to the 1st post, You’ve made it clear your “whys” are merely your opinion, and I appreciate your courage and honesty to call it like you see it, even if it’s not a popular topic. I’ve noticed the same dips in the majority of my keys since 2015. That is a fact. The feverish high-dollar snatch and grab for the key tie-ins by speculators has leveled off and GPA analysis and raw values isn’t as skewed by anomalies this year. I think a big contributor to 2016’s leveling off is now “superhero fatigue” from overexposure in the movies and TV. BvS really set things back and all to the superhero tv properties are garbage compared to the source material. Gotham, Agents of Shield and the CW are just noise. Even the “critically acclaimed” Netflix/Marvel stuff seems like a one 2hr movie worth of content stretched to 13 episodes. Where’s the Breaking Bad of superhero shows? At this point, I feel like it’s best to focus on books that appreciate solely based on their importance to the comic medium alone, unless flipping is one’s investment style. That’s my two cents. Keep up the great posts and keen insight!

Oops, I almost missed your comment Darren.

You’ve hit it on the head. 10 people can look at the exact same stats and extrapolate 10 different perspectives, in part due to their passion for the hobby. I try to promote informed and rational thinking when it comes to our wallets so I’m merely trying point out some of the influences that can impact the market.

I totally agree with you, that the best books to invest in are the ones that don’t require Hollywood hype to appreciate but it’s also possible that the media can and changing tastes can flip this idea upside down. As such, it’s a good idea to keep an eye on these trends so that we don’t get stuck with anything or miss an opportunity.

Many thanks for your comment.