About a month ago I was getting the sense that the ragging bull comic market was levelling off and in places even retreating. Looking around today I’m still seeing impressive price after impressive price come in. I don’t think the buyers out there got the memo that things were slowing down. I remember years ago coming up with the realization that one should never bet against comics. Comics have dipped many times over the past 25 years but they’ve always roared back. I’ve been guilty of not trusting my own advice and inactively sitting out these past few market corrections, the last one being just after the Avengers End Game movie left everyone wondering what was next, then Covid hit!

It’s all quite impressive. So impressive that some very big money is entering the game. I read with interest the story of CGC’s parent company Certified Collectibles Group being bought into by an investment group led by Blackstone Tactical Opportunities, they valued CGC’s parent company at 500M. I also read that much of the current ownership will retain a minority share and keep running the place.

So the premiere comic grading company gets bought out for huge bucks by a large investment firm? Does this bode well for the future of comic collecting and investing? Why would you shell out all that quid if you weren’t sold on the future of collectibles (CCS does not just grade comics). What interests me is what this company could do to promote the demand side of the equation? Demand seems to have organically grown up until recently, can a big investment firm like this go out and sell the merits of owning graded comics? I smell comic-based derivatives coming soon.

Will Blackstone go the way of the PSA card grading company and acquire an auction house as well (PSA parent company bought into Goldin Card Auctions)? Would there be a conflict of interest then? Interesting times ahead for sure.

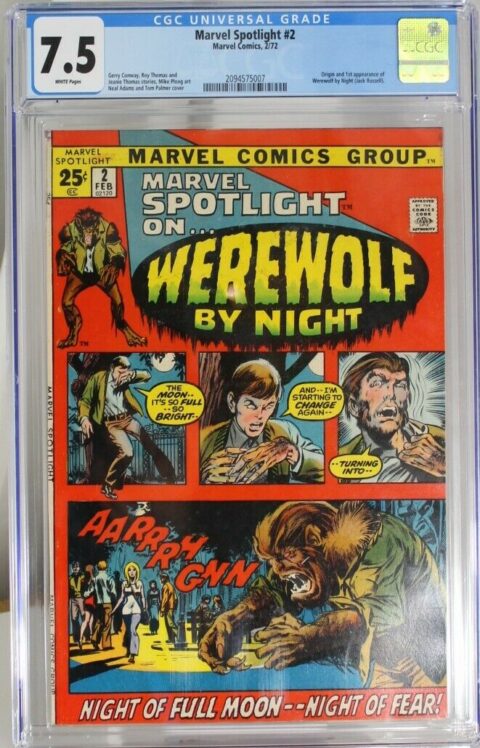

We’ve been doing our part in supplying the market with quality graded comics, our eBay auction under our internationalcollectiblesexchange banner had a strong week capped off last night with a nice sale of a CGC 7.5 White Pages copy of Marvel Spotlight #2 featuring the first appearance of Werewolf by Night. I love this book and find it still way undervalued compared to its much more expensive cousin Marvel Spotlight #5. Our copy sold for $861.99 which was well ahead of the 90-day average and just below the last sale of $886.00. Advantage Buyer.

Blackstone Tactical Opportunities… wasn’t that one of the shadowy secret black ops groups that Jason Bourne or somebody took out?

Yes, could be interesting times ahead for comics. I got some comics, where can I get a supply of slabs?

I generally agree with you Walt, although, probably to a less degree if we got into specifics like timing and the various pockets in the market. And unlike sports cards, I think the slew of TV shows helps to keep the momentum going.

Also interesting is that institutions and hedge funds like Blackrock and Fundrise are buying up homes in the US, paying up to 20% above ask. These companies manage billions, and has large research teams… None of this is reported by the mainstream in a meaningful way, except to give them a voice to justify their actions. I don’t know what all this means but I suspect there is a greater undercurrent at play here.

This one’s for Nestor:

https://youtu.be/T1l7EPDXmCM

It’s are to see the big picture… let alone understand the implications down the road:

https://www.dailyveracity.com/2021/06/11/corporations-are-buying-up-thousands-of-houses-and-pricing-americans-out-of-the-market/

Charlie, I try to hold my tongue, but that is utter nonsense.

You act like something nefarious is going on. This is just investment. This “pricing Americans out of the market” language is silliness. How long ago was I “priced out of the market” for FF #48? I can tell you it was before this recent boom. I don’t see any articles about how this is some kind of nefarious activity by comic collectors. All of this is just supply and demand.

You can still buy a house, you just get to whine and cry more about it costing too much. Homebuyers would like there to be more supply – but there isn’t. They remember the “good ol’ days”, first of too-easy credit before the financial crisis, then low prices because of too few buyers after. Now everybody wants to move out of apartments thanks to Covid, and prices are “too high”. This isn’t rocket science or some big-money plot, it’s just the same sloshing of value between money and goods that we’ve had since time immemorial.

Back to the topic at hand. Heritage and CCG are a natural fit, I’ve expected them to be under common ownership for years. Similarly they should take out GPA, that would be a drop in the bucket. This play is the California Gold Rush play, even better now because at least CGC is effectively a monopoly (I don’t know much about the other grading pieces – CCG still appears to have an uphill climb with NGC vs. PCGS). It’s always better to own the pipes and let others fight it out over what flows through the pipes – either way you get paid for the use.

The key thing for somebody with capital tied up in the collectible is that this investment supports liquidity, which is good. We still have to worry about our collectible going out of fashion, but that was always the game.

Hey Chris, I think you’re might be making some assumptions. Can you clarify what you consider to be “nonsense”? Something I said or something in the links provided?

The correlation I was making with Wall Street entering the collector market and becoming landlords to average folks like you and me… was the continued corporatization of America. Are you suggesting this is “nefarious”?

Before you respond, if you decide to respond… consider this: If corporations lobby hard to suppress progressive values, and pay law makers in the form of donations, ie “dark money” not to pass a higher minimum wage, then turn around and buy up assets with the intend to turn a quick profit as a way to recoup their investment, to the point where folks working for $7 per hour can’t afford to buy an FF#48, let alone a house… would this be “nefarious” or just the free market at play? What if that those same corporations also expect subsidies, tax breaks, loop holes and bailouts if/when things go wrong? Is this “nefarious”?

Let’s think critically here. You choosing not to buy an FF#48 when it was $1,000 is very different than you not being able to buy the same FF#48 at $20,000. What is the time gap in between, what was your salary during these times and what is going on in you life at these times? I’m not complaining about the value of said assets… If an FF#48 goes up 20x due to demand, so be it. I’m saying that a store like Big B Comics will never be able compete with Amazon, and whatever mom & pop shop that still exists in America… does so because Amazon allows it to.

Also keep in mind that, in many ways business gentrification could be a good thing. But capitalism without restraint is like leaving a child in a candy store without the parents. The result is a homeless epidemic and the collapse of a profitable business like Toys R Us (yes, I know they’re still around here in Canada but the story behind the headlines was amazing).

I only got on this site to try to figure out if a copy of Avengers 116 i bought has been trimmed. This is the first exchange i’ve seen. I know nothing abou this site, but my gut is telling me this thread probably isn’t what most of the threads around her are like. with that said, i am thoroughly exchanging the volley. Your serve, Chris!

The best advice I can offer, Joel, is to download a number of pics of 116 and compare them with your copy to see it has been trimmed.

In my experience, trimmed comics are usually from bound volumes and, occasionally, early Marvels that displayed a defect called ‘Marvel chipping’, where the cover stock used a paper that tended to break rather than cut, resulting a chipped effect.

Your comic is newer and made of a different paper, which shouldn’t chip; so unless it was in a bound volume, spine damage usually gives that away, your book shouldn’t be trimmed. A comparison between yours snd online pics is about the only way to tell.