Most comic collectors would covet a collection that includes the first appearances of Wolverine, The Punisher, Iron Fist, Hobgoblin, Spider-Man’s Alien Symbiote suit, Elektra, Phoenix, and Kitty Pride. For good measure we’ll add the debut of the “All-New, All-Different” X-Men of X-Men #94 and Giant-Size X-Men #1 that introduced the world to Storm, Colossus, and Nightcrawler. Since their introductions, all of the above characters continue to be among the most popular in the Marvel Universe and the comic world. Not only are they staples on comic shelves but they have all been featured in movies, cartoons, and video games, solidifying their place in pop culture history.

Besides their continuing popularity, these characters have another thing in common: they were all born in the Bronze Age of 1970 to 1985. During the Bronze Age, many of the creators, artists, and writers that defined the Silver Age stepped aside for younger talent. The Stan Lee/Jack Kirby X-Men of 1963 vanished in 1969, resurfacing in 1975 with Len Wein and David Cockrum at the helm. In addition to new talent taking the reins, social issues such as racism, drugs, and alcoholism influenced storylines, ushering in a darker, more realist tone. Who could forget Harry Osborn’s LSD trip in Amazing Spider-Man #120?

As a final sweetener to this collection, all titles will be graded 9.8 by CGC.

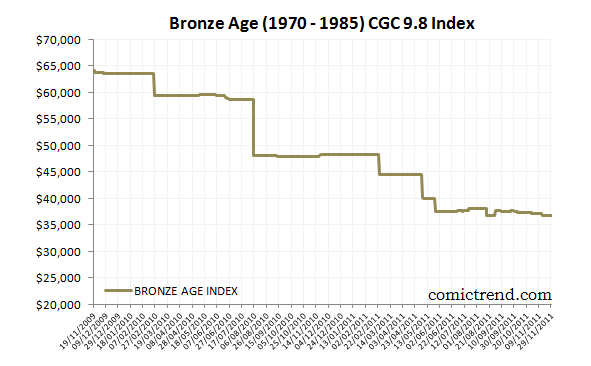

Would you be shocked if I told you this collection has experienced a devastating loss in market value over the last two years? In late 2009 a collection of key Bronze Age titles (list below) would have been worth approximately $65,000. Using the latest auction data, this collection would be worth around $36,000 today. A stunning 45% drop.

This basket of comics includes Amazing Spider-Man #129, Amazing Spider-Man #252, Amazing Spider-Man #238, Daredevil #168, Giant-Size X-Men #1, Incredible Hulk #181, Iron Fist #14, Secret Wars #8, Uncanny X-Men #129, Wolverine Vol 1 #1, X-Men #94, and X-Men #101. Transaction data taken from real auctions completed at eBay, Heritage Aucitons, and ComicLink. Titles chosen based on available auction data.

Why have these titles fallen so far? Well, perhaps a better question is why were they so high in the first place? Why did Amazing Spider-Man #129 settle at nearly $15,000 in a 2008 Heritage auction? The latest auctions have settled around the $5,000 mark! Rampant speculation due to the stampede of superhero movies? The tail end of a CGC/slabbing mania? The mirage of high grade scarcity? All of the above!

I’m going out on a limb to say that the violent price declines are over. To be sure, these comics might continue to fall in value. However, I believe that high grade Bronze Age values should stabilize here. Any near mint raw titles lurking out there have had plenty of time to be slabbed (the number of 9.8 X-Men #94s on the CGC census has jumped from 3 to 11). Movie mania has died down. These titles now stand on their own merit. No, they will NOT skyrocket back to anywhere near their 2009 peak values. But if you’re a fan of these characters (the most important thing) and believe they will continue to have an important role in the comic world and pop culture in general, buying at current prices is not an outrageous idea.

Very interesting article. Does this list include Green Lantern #76 and Star Wars #1? Might it be said that it’s not bronze age comics that have fallen but a certain set of characters who are less interesting now than they were a few years ago. Sabretooth who? Hobgoblin? These are minor figures compared to the long-enduring characters, and I wonder if there aren’t as many books going up as down in value overall? Also, this list seems heavily tied to Spider-Man and X-Men, which must have an effect (and I expect the excitement over both of them will continue to decline).

Any one who’s been watching the monthly auctions regularly has known this for some time now but it’s not the just the bronze age that’s been affected. I’ve noticed mid to low silvers taking a hit as well. The value of higher grade silvers seem to be holding but there are less being traded these days.

Every pundit I speak to points to the growing census numbers… In which case what they are really saying is that books can only trend down since logically, as time goes on, more and more graded book will appear… To say that the values have stabilized is pure conjecture. Perhaps they have for some books while others will continue to fall. But really, the census is relative…

There are a lot of factors at work here. In 2008-2009, the economy was much stronger… Unemployment today is at record highs so when confronted with putting money down on an ASM#129 versus paying rent, necessities will take priority.

Pressing also plays a part since the same book can get ironed out and re-slabbed, not once, but possibly multiple times. Since pressed books are not tracked… there’s no way to gage their impact. But virtually every hardcore collector I meet presses all their books and a quick scan on the CGC boards will confirm this. They also agree that the census numbers are skewed.

Like the stock market, human nature is a big factor as well. Collectors get carried away and jump on the CGC band wagon, creating a momentum that can’t be sustain. The stock market has a 100 year history so we can see the highs and lows and conclude that the process is cyclical. CGC is relatively new… but more importantly, despite all the media attention the comics have gotten, collecting remains niche. That is, the stock market is a part of the world economy. You don’t have to be in finance to love money…

…Comics, however have an aging and shrinking pool of vintage collectors. The big collector crash is yet to come when baby boomers start to dying off in more significant numbers. The concept of scarcity is relative to demand so if there are less collectors in 20 years (because many will be dead), the lack of sustainability translates to less demand.

Big books like Act#1 and Det#27 will always have value due to their historical relevance outside the collector market. Many collectors are saying that the market will rebound in 5 to 7 years (along with the economy). I’m also of this camp because I believe there is enough time for another run up before I’m dead… but my belief is based on how I interpret past events and not on any factual knowledge about what’s ahead of us.

A very nice write up… but I’d love to have more objective insight (if that’s possible). The problem with conversing with industry pundits is that… they all love comics! And many have a financial stake so it’s difficult to have a meaningful dialogue with these people.

^_^

Hi Simon,

This chart does not include Green Lantern #76 or Star Wars #1. I wanted to keep this list focused on the big Marvel character introductions of the Bronze Age.

Interesting point about the characters. For sure the movies created a lot of hype for many of the characters. They’ve all come back down to earth.

All the titles in the Bronze Age chart have actually fallen uniformly. Hobgoblin first appearance (ASM #238) has fallen just as much as Wolverine’s (IH #181). In fact, they’ve all fallen by about 50% since 2009 (Wolverine Limited #1 has held up the best).

The list seems to be focused on X-Men and Spider-Man only because these books are the most frequently traded. I wanted to include more Bronze books such as Ghost Rider #1 but could not find enough data points. I also wanted to include Daredevil #131 (first Bullseye) but again the data just wasn’t there.

The list is not meant to be an exhaustive or definitive Bronze Age list. Just wanted to put together a quick list to show that many of the great Bronze Age books can be had for 50%+ less than just two years ago.

Charlie,

Great points. The problem is that we cannot be “objective” when it comes to collectibles such as comics. Unlike stocks or bonds, comics do not have any intrinsic value. We can say a bond is worth par value because it will be redeemed at par at maturity. With a stock we can say that the company produces a certain cash flow stream which can be discounted to arrive at some sort of valuation. Even if we do this analysis, bonds and stocks will fluctuate wildly around what we think they are “worth.” Or we may just be dead wrong in our analysis.

So with comics, which have no intrinsic value, it’s a much, much harder job to get an understanding of where the market is and where it’s going. What I’m saying is that the reasons behind the fall (economy, movie hype, growing census, CGC bubble in general) are stabalizing which means that the prices should stabalize. Yes, they may continue to fall, but I would be very surprised if two years from now a 9.8 Amazing Spider-Man #129 trades for $1,500 or if Daredevil #168 trades for $200.

That’s my very subjective opinion 🙂

Very interesting points all round. Another issue is that this is all about the highest graded copies, which can have huge swings in price. I’m buying CGCs around the 9.0 to 9.6 for less key books, and I wish the prices had all gone down by 50% but I’m sure they haven’t. I’m also certain the CGC bubble will not burst because if there’s one thing I’ve learned in the past couple of years as a new collector it’s that buying ungraded books is a bad idea when you’re spending a lot of money – I’m surprised how common restored Bronze books are, and now I would only buy CGC-ed books and tatty readers. I wish CGC was just a little cheaper, because I think there is huge potential for expanding what they do, to make online purchases of lower-grade comics much more reliable and agreeable.

I’d say with a 50% decline that the CGC bubble has already burst. The loose definition of a bear market with stocks is only a 20% to 25%. The question now is, can or will the market recover? For the answer to this, I would look at human behaviour. People are creatures of habit and we often do things that defy reason… thus the cyclical nature of the stock market… and the proliferation of sex, drugs and rock and roll, ie; Hollywood.

Steinhoff is correct in saying that comics have no intrinsic value… so perhaps the art market would be a better comparison. The art market has been around for a long time and is prone to high, lows, and crashes. Like comics, it’s also prone to trends. Work by a hot Soho artist can sell of thousands… 10 years later, it’ll sell for half if he’s no longer a fan fav. The art market has auction houses like Sotheby’s who deal in art, diamonds, wine… which Heritage and CC tries to emulate.

It’s important to note that an index may go up and down but some comics or talent may never recover. I also don’t think an ASM#129, CGC 9.8 will go down as low as $1500 but 2-3 years ago when this book was trading north of $12k… would you have believed it could be picked up for $4200?

……….does this mean we can actually go back to reading comics again, instead of speculating on how much we could make if we sold our stuff?

How do you read them if they’re sealed in a plastic case? 😛

You buy the omnibus or trade paperback. It won’t matter if your hands are greasy.

An overlooked possibility about Bronze Age and later, is that there may be sleeper comics that become more valuable as it is realized that they are an important part of pop culture, but were not saved in high grade. Take for example Star War reprints (from 1977). There were a lot of these printed, but very few have been slabbed and possibly very few are in high grade. These are called reprints, but are these really reprints? I remember these followed right after the originals. By today’s standards they would be called second prints and would command a much higher value than a reprint.

Some better know comics are in short supply in high grade. For example, Giant Sizes are in short supply in high grade (i.e. Daredevil & Thor).

Also, consider the Simpsons Comics from 1993-4. You see a lot of #1’s traded. But high grade early copies of 2 and on are in short supply. There is only one #4 graded 9.8 (same with #5).

Good points, Peter!

I refused to accept the GCG/grading craze, I think it’s a complete scam that has seriously harmed the value of non-graded comics. As far as intrinsic value, stocks have no intrinsic value either, their price can go from $100 a share to $1 a share for no good reason because there is no calculation that sets the stock price, just buying/selling and market manipulation.

Bronze Age

I believe that in the next ten years years we will see significant growth in Bronze Age values, as well as in lower and mid-grade Golden and Silver Age comics. Here are some reasons.

The pop culture interest in certain comic books characters is showing no sign of diminishing. Competing studios own rights to various characters and are not likely to give them up any time soon.

20th Century Fox owns X-men characters, Daredevil, Fantastic Four and Silver Surfer.

Columbia Pictures (Sony Pictures) owns Spider-Man and Ghost Rider.

Marvel Entertainment (Disney) owns Avengers, Thor, Ironman, Hulk, Captain America and a host of Bronze Age heroes (i.e. Nova, Ms Marvel, Star Wars, Spider-woman, She-Hulk, etc)

Disney has already drawn on the main tier Marvel heroes. Next destination available for expansion may very well be the Bronze Age characters. Possible appearances of Nova in Guardians of the Galaxy and Ms Marvel in an upcoming Avengers movie (or a Nova movie and a Ms Marvel Movie) will increase interest in these characters. The upcoming Star Wars movies will increase interest as well.

Kids and young adults caught up in today’s pop culture will purchase digital comics in increasing numbers, keeping print runs of comic books low. Eventually, some of them will want to invest in related vintage comics.

I had seven teenagers in my home a few weeks ago. These were not comic collectors. I showed them a variety of comics from Golden to Modern ages. They were really excited, particularly about the older vintage comics. I made their day when I let them each have a golden age (2.0) and a common modern super hero comic. I could hardly believe how excited they were to see this material. Kids don’t commonly come across comic books. You have to seek out a comic books store. When I was a kid, comics were everywhere. They are a real novelty to young people. As they become adults with disposable income, some of them will find it cool to purchase old vintage material, particularly if any of it is related to the pop culture influences they have grown up with.

This pop culture interest is worldwide. Overseas purchases will contribute in diminishing the supply of vintage comics from all ages, including Bronze. As high grade comic prices continue to become more expensive, investors will take advantage of lower cost mid-grade comics, which will ultimately drive these prices up.

Exactly how long will it take for this to happen? I can’t say. However, who can deny the world wide pop culture influence of so many comic characters. Purchasing mid to lower high grade comics may have a greater pay off down the road than 9.8 investments.

Can I be wrong? Yep. However, this is my view of things. Don’t you wish that when you were a kid you knew then what you know now? In the 60s and 70s I would have worked over-time to get money to invest in key issues and be living like a king today. I don’t know if post Bronze Age comics will ever have the upward investment potential of Bronze and earlier. However, if Disney invests in these characters and we see games, cartoons, etc. promoting these characters, then there is a lot of room for growing profit in the Bronze Age.